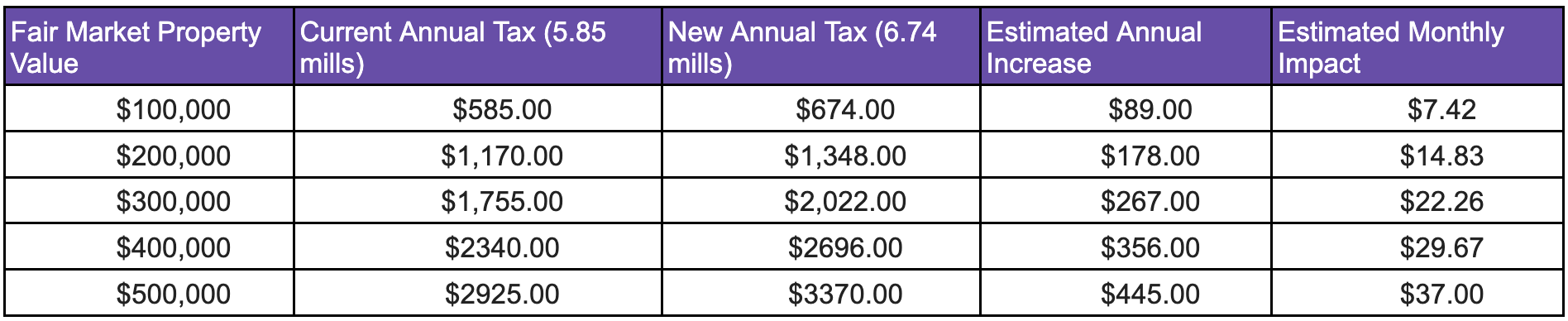

What's the Cost?

Gratitude for Community Support

We are incredibly grateful for the community's overwhelming support in the November 2024 Referendum. This commitment allowed us to address critical, high-priority district-wide capital maintenance needs. We focused on essential infrastructure, including:

Updating building systems: Mechanical, electrical, and plumbing (leaking pipes).

Repairing exterior enclosures and roofing.

Improving site work: Drainage, asphalt, and erosion control.

Limited interior finish improvements directly impacting safety and security, such as secure entrances.

Upgrading bus transportation communication.

This investment was about responsible stewardship of our community's assets, ensuring a safe and functional environment for our students and staff.

Check Out the Progress

****The one thing the November referendum doesn’t cover is our daily "Operational" budget—things like transportation, staffing, classroom supplies, student programs, technology, etc.

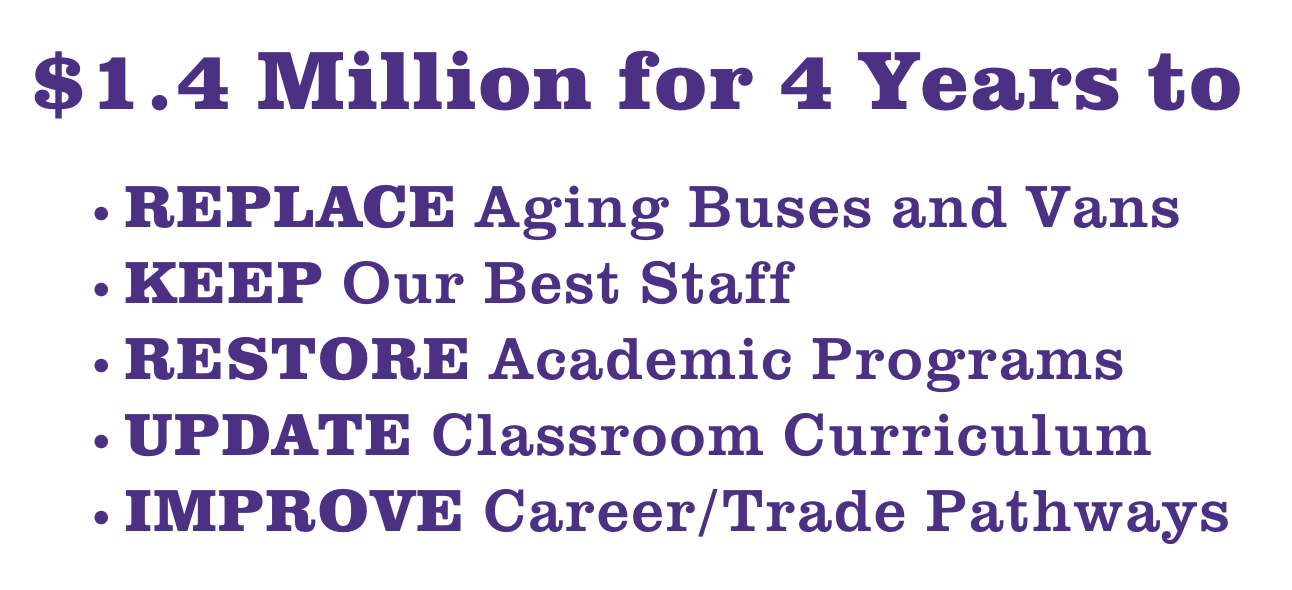

Replace Aging Buses and Vans

Importance of Public Schools through Wisconsin Students' Eyes

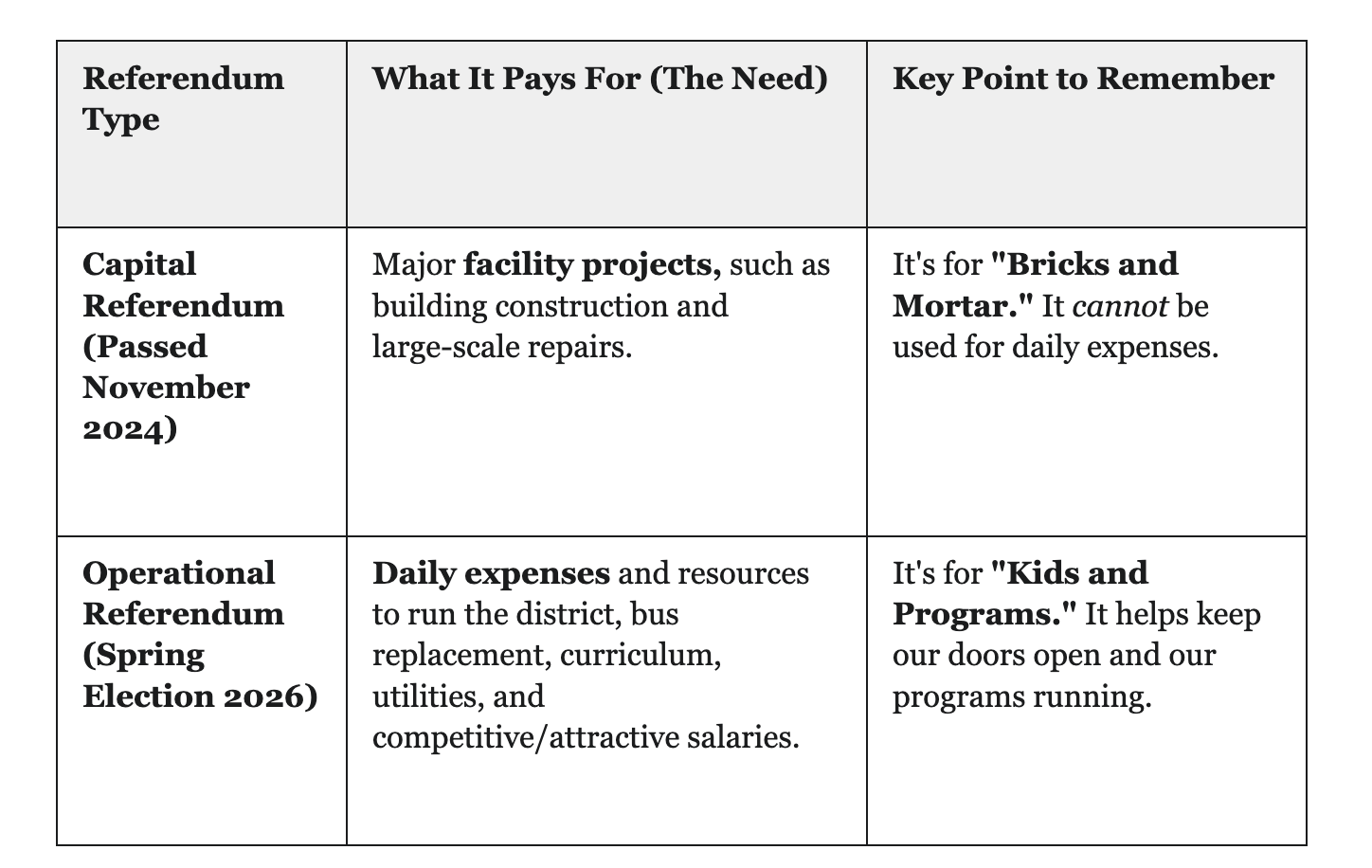

What's the Difference between a Capital & Operational Referendum?

School funding is complex! ~How is our school funded?

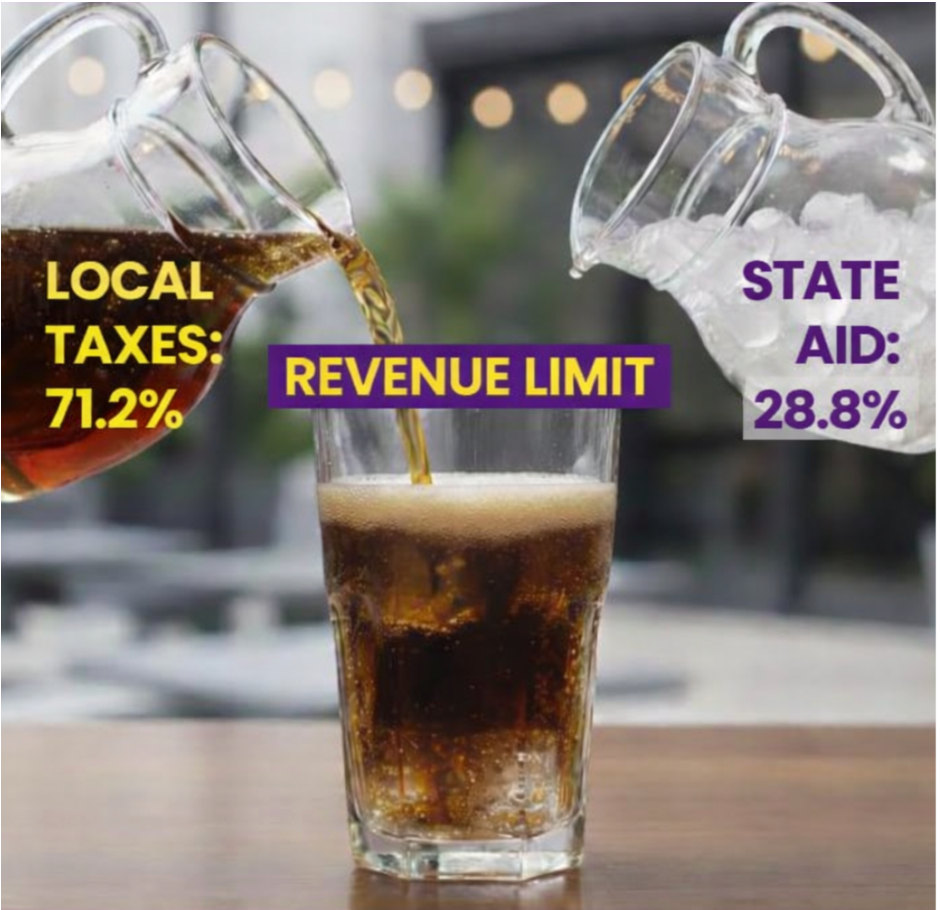

This picture shows how money is collected to pay for our students’ learning opportunities.

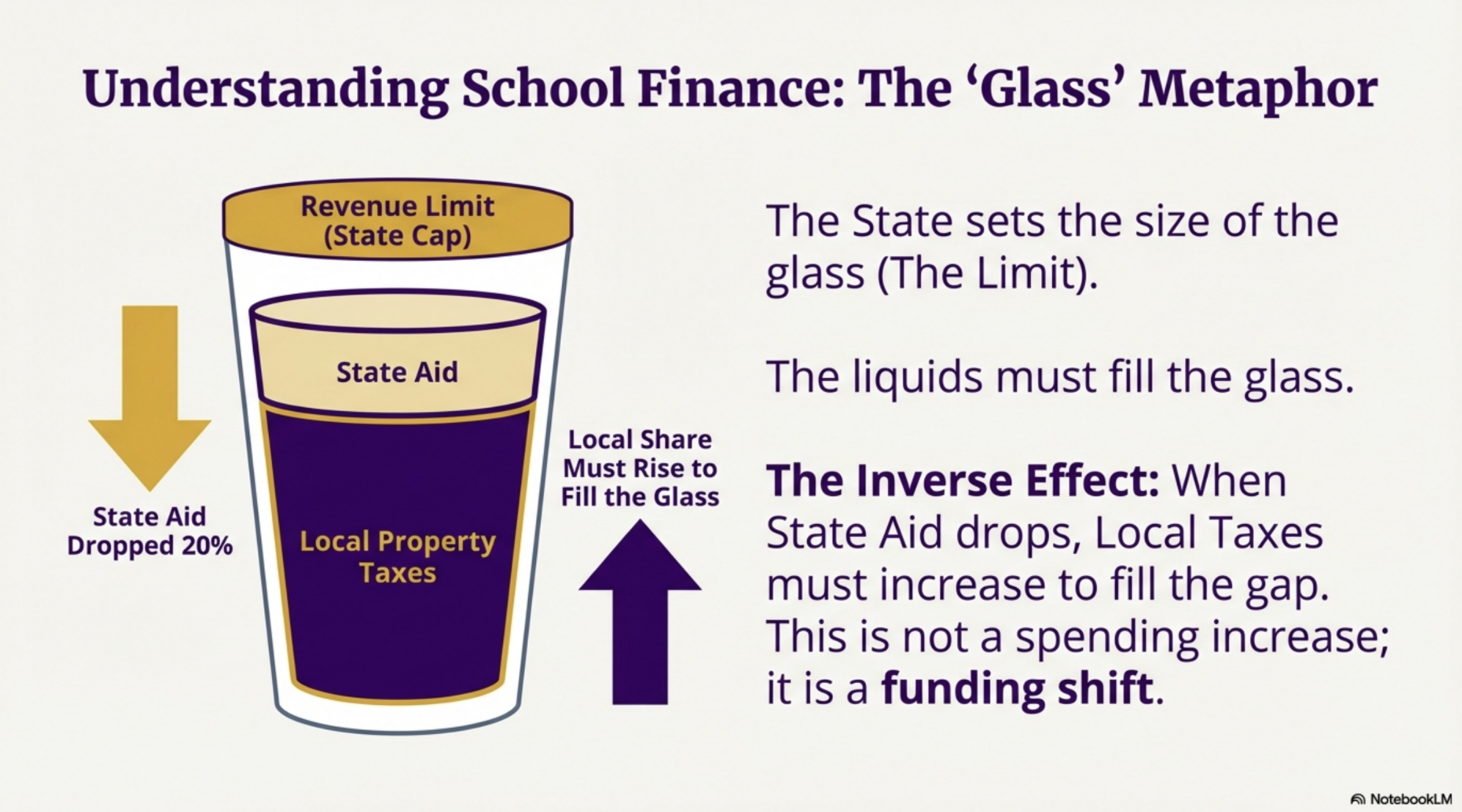

The Glass – Revenue Limit

The glass represents the district’s revenue limit. This is the maximum amount of money a school district is allowed to raise each year to pay for school expenses like teachers, transportation, supplies, and building costs.

The Liquids – Where the Money Comes From

Two different sources of money are poured into the glass:

Local Taxes (the dark soda on the left):

This money comes from property taxes paid by people who live and own property in the community.State Aid (the clear liquid or ice on the right):

This is money provided by the state to help support school districts across Wisconsin.

The Mix Is Different for Each District (This means some districts are given more state aid and pay less in taxes; Click here to see the Difference between schools).

The state uses a formula to decide how much state aid a district receives. One important factor is how much property value there is per student in the district.

Districts with lower property values per student receive more state aid.

Districts with higher property values per student receive less state aid and rely more on local taxes.

What This Means for Our District:

For the School District of Westfield, a larger portion of our revenue limit comes from local property taxes, and a smaller portion comes from state aid, as shown in the image.

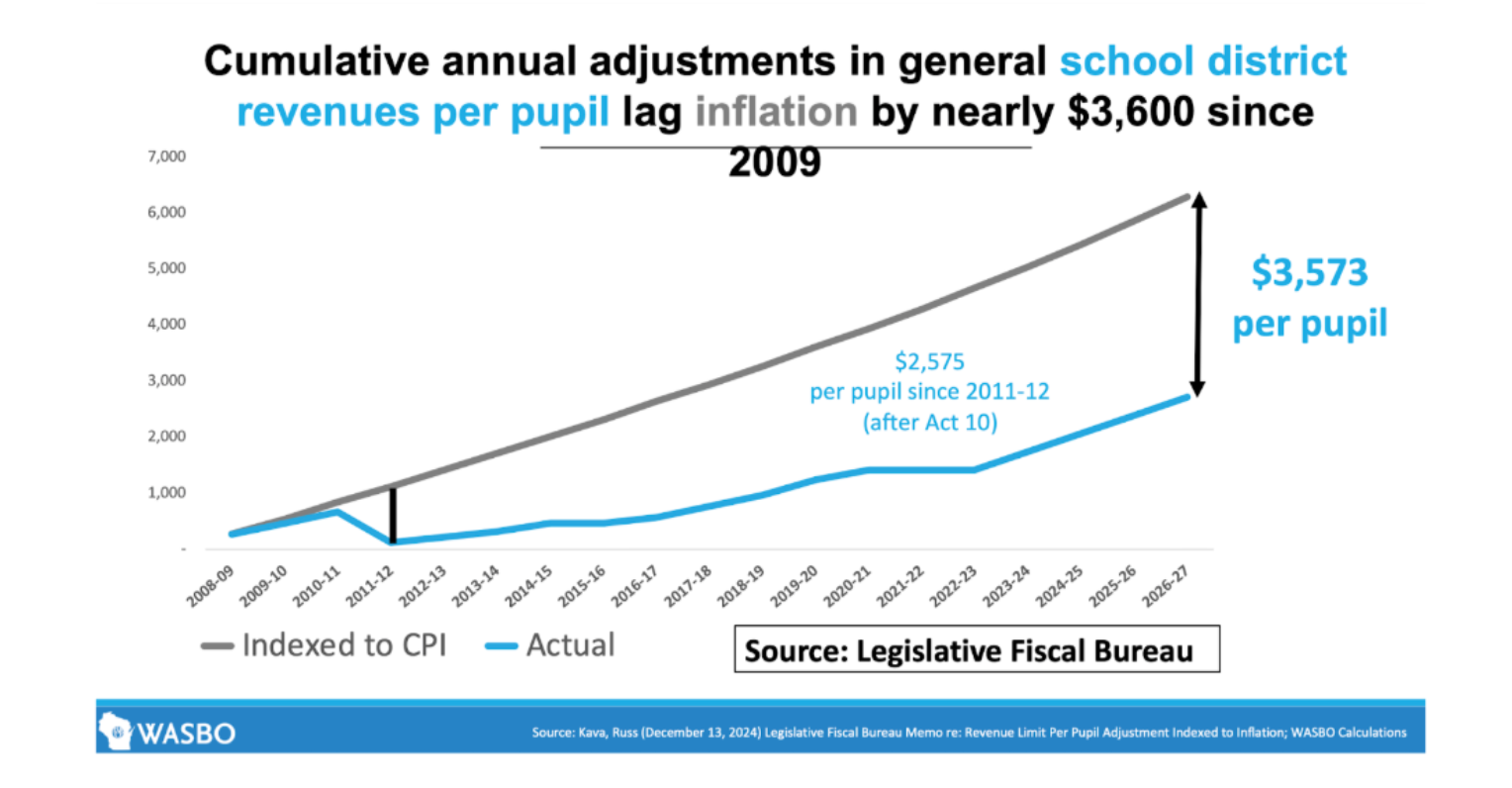

When did this start, and do all schools get the same funding?

Wisconsin set school revenue limits in 1993–94, based on what districts were spending at that time. Prior to that, local school boards had the authority to adjust their funding as needed.

Because the School District of Westfield was a low-spending district in the early 1990s, we remain a low-spending district today. In fact, we are at the lowest funding level allowed by the state, known as the “floor,” and have remained there ever since.

In 2009, the state stopped adjusting revenue limits for inflation. While the cost of operating schools has continued to rise, revenue limits have not kept pace. As a result, Westfield now has approximately $3,573 less per student in revenue authority than it would have if inflation adjustments had continued—equaling about $3.8 million less for our district this year alone.

The shortfall pictured equates to $3.8 million in revenue for this year alone. Notice we are asking for $1.4 million, based on community feedback. Consequently, the District will still need to make cuts.

What about state aid? We pay taxes and the state provides "equalization aid "...right?

First, this year we received 20% less state aid. This shifted the burden to taxpayers. State aid has an inverse effect on property taxes. "When our equalization aid goes down, our local taxes go up."

It is crucial to understand that a decrease in equalization aid is not a spending increase by the district; it is simply a shift in who pays. When state aid decreases, local taxpayers are forced to make up the difference, leading to higher local property taxes.

Questions

Contact

Michelle Johnson,

District Administrator

michelle.johnson@westfieldpioneers.org

608.296.2141 ext. 1011Veronica “Roni” VanDerhyden, Business Manager veronica.vanderhyden@westfieldpioneers.org

608.296.2141 ext. 1006

Learn More

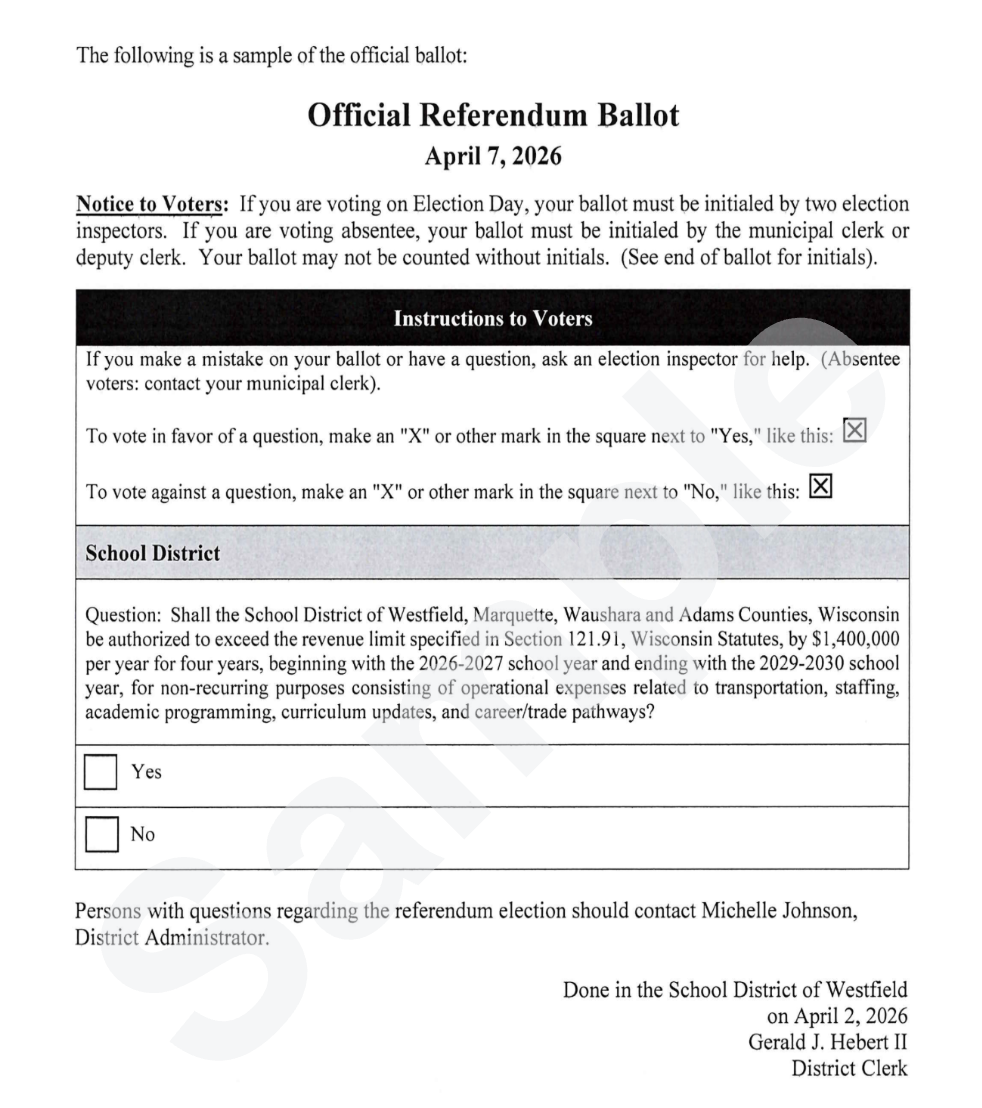

Voter Information

Go to www.myvote.wi.gov to:

Find your polling place

See what’s on your ballot

Register to vote

Request your absentee ballot

Vote on election day between 7:00 a.m. and 8:00 p.m.

Questions: Contact your local municipal clerk for follow-up information or further details